[All links lead to Spanish-language websites unless otherwise noted.]

Discussion of the SICAV [en] investment scheme reignited this summer in Spain, with the debate focusing on some of the well-known people and companies which take advantage of that fiscal tool in order to avoid paying taxes. The SICAV (which in Spanish stands for “investment company with variable capital”) are collective investment schemes with a special tax treatment in Spain which requires only 1 percent be paid on profits.

A few months ago, law and economics professor Guillermo Rocafort published his book SICAV, Tax Haven in which he explains the details of these schemes, which were created to prevent massive amounts of wealth from fleeing the country in search of more benign tax codes.

In an interview with Periodista Digital, Rocafort noted that one of the biggest problems with the structuring of Spanish SICAV funds is that a large part of the capital is invested in foreign counties and therefore does not stimulate the Spanish economy, like French or German SICAVs do, making their capital much more “patriotic” and in a way justifying their tax advantages.

This YouTube video uploaded by periodistadigital on January 2, 2012, shows a Spanish-language interview by Periodista Digital of Guillermo Rocafort, author of the book SICAV, Tax Haven:

By law, each SICAV must have a minimum of 100 stockholders, but in reality, this standard is avoided by naming a series of straw men, known vulgarly as “mariachis,” so that in fact each SICAV is controlled by only one person or one group. The names of those people are usually shrouded in mystery, but Rocafort's book reveals the names of some famous SICAV stakeholders.

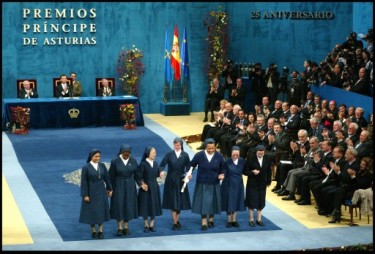

The Daughters of Charity, Prince of Asturias Award for Harmony 2005. Photo from the Prince of Asturias Foundation

According to Rocafort, among those SICAV shareholders are large companies such as the owners of Zara, Pronovias, and Mango. Others are closely associated to athletics, such as soccer players Fernando Hierro and Iván de la Peña.

The church also has its SICAV, in the names of Ángel Vallejo, the Daughters of Charity, and the Hospital Brothers. Among celebrities, film director Pedro Almodóvar and Infanta Pilar of Spain, sister of King Juan Carlos.

It is precisely those last two famous shareholders who have thrust the SICAV investment scheme back into the headlines this summer.

On May 3, coinciding with the World Press Freedom Day, the Catalan website Anuari Mèdia.cat [ca] published their list of Media Silences for 2011. It pulls together a compilation of 15 reports about the news or issues which were most censured, or at the least silenced, in the media throughout last year.

The first on the list, a report titled ‘Six Borbouns and Hundreds of Mariachis,’ talks about the SICAV of which la Infanta Pilar and her five children are stakeholders:

Pilar de Borbón y Borbón – Dos Sicilias (…) tiene cinco hijos (…). Ellos cinco son los únicos socios que aparecen censados en la SICAV. (…) El resto de accionistas ni siquiera aparecen. Para que la SICAV sea legal hacen falta un mínimo de cien, y a Labiérnago 2000 le sobran: tiene 237, según la Comisión Nacional del Mercado de Valores (CNMV), pero 231 no se sabe quiénes son.(…)

(…) Al cierre del ejercicio de 2001 su activo [de la Sicav] ya superaba los 4,3 millones de euros (…) Labiérnago 2000 ganó [en 2009] 392.970 euros, por los que pagó 930 euros de impuestos, según las cuentas de resultados que figuran en los registros. No falta ningún cero. Para que se hagan una idea, si una empresa corriente tiene estos beneficios, debe pagar un impuesto de sociedades de unos 100.000 euros. Si una persona los gana trabajando, más de la mitad de las ganancias, unos 200.000, son para Hacienda. (…)

Si los negocios de Pilar de Borbón no se caracterizan por la ejemplaridad, tampoco destacan por su transparencia. La SICAV labiérnago 2000 no es el único negocio de la infanta. De algún lugar tiene que salir el dinero que invierten allí, pero el origen de la fortuna es desconocido.(…)

Pilar of Spain, Duchess of Badajoz, Grandee of Spain, Dowager Viscountess de la Torre (…) has five children (…). Those five are the only shareholders that appear registered on the SICAV. (…) The rest of the stockholders don't even appear. In order for the SICAV to be legal, a minimum of 100 is necessary, and the Labiérnago 2000, as the fund is called, has plenty: it has 237, according to the National Securities Market Commission (CNMV), but it is not known who 231 of them are (…)

(…) At he end of the 2001 fiscal year, the SICAV assets already had surpassed 4.3 million euros (…) Labiérnago 2000 earned [in 2009] 392,970 euros, on which 930 euros were paid in taxes, according to the financial statements that feature in the records. No zero is missing. In order to give an idea, if an ordinary company earned this profit, it would have to pay some 100,000 euros in corporate taxes. If a person received that from working, more than half of the earnings, some 200,000, are for the Ministry of Economy and Finance. (…)

If Infanta Pilar's dealings are not characterized for their exemplary nature, neither will they be noted for their transparency. The Labiérnago 2000 SICAV isn't the only venture of hers. The money that they invest there has to come from somewhere, but the origin of that fortune is unknown. (…)

The news has infuriated cybernauts. As seen on Facebook:

Alberto Deza Rey: Asi, asi, dando ejemplo, los que más derechos se ponen ante la bandera….puuuaaaajjjjjjj!!!!!!

Susana Martinez Lopez: qué “patriotas” y luego nos piden que arrimemos el hombro y que todos juntos “salimos de esta” JA, JA Y JA!

The second SICAV-related news appeared at the end of August in the online publication El Aguijón on filmmaker Pedro Almodóvar:

(…) Según ha podido saber Diario El Aguijón, las operaciones económicas de la SICAV de Pedro Almodóvar llevan siendo seguidas de cerca desde hace aproximadamente un año por las autoridades económicas españolas, que investigan los ingresos obtenidos por el director fuera de nuestras fronteras, y que presuntamente podría haber estado blanqueándose a través de la SICAV, y de otras inversiones y negocios, eludiendo así el pago de impuestos. (…)

Of course, the news did not go unnoticed among netizens, such as Ismael Asperilla, who commented on Twitter:

@IsmaelAsperilla: @Riikkki Ah, Almodovar, ¿el mismo que tiene una SICAV y al que acusan de blanqueo de capitales?. Vaya, vaya… ¿y le preocupa lo del IVA?.

Joaquín A. de Toledo, Miguel Rivas and Tomas Harrow pointed out the inconsistencies between the film director's political sympathies and his lifestyle:

@carlossavedra: Para los q no saben qué es la “izquierda caviar”: “La SICAV de Pedro Almodóvar investigada por evasión de impuestos y blanqueo”.

@gauchiberrimo: IZQUIERDA POLITICA VS DERECHA ECONOMICA: La SICAV de Pedro Almodóvar investigada por blanqueo | Diario Aguijón http://www.diarioelaguijon.com/noticia/4486/LOS-AGUIJONAZOS/La-SICAV-de-Pedro-Almodovar-investigada-por-evasion-de-impuestos-y-blanqueo.html …

@ThomasHarrow: #Almodovar, el q no paga impuestos con su #Sicav, usa un aeropuerto público pagado por tos pa su película. Vergüenza de hipócrita progre

5 comments