This post is part of our special coverage Global Development 2011.

While the African Development Bank announced three days ago that it will downgrade its forecast for growth in Africa as a result of the turmoil in various regions of the continent, the rate of return on foreign investment is higher in Africa than in any other developing regions.

Still, the perception hold by many investors is that doing business in Africa is a risky proposition and that the continent has yet to reach the status of a land of opportunities.

Many endeavors have proven that perception to be inaccurate. In this video by the Organisation for Economic Co-operation and Development (OECD), Donald Kaberuka and others discuss Africa as a a new emerging markets frontier:

Eric Kacou in Kigali opines that what is needed to succeed on the continent is a new brand of entrepreneurs; the ones he calls the “Archimedes Entrepreneurs”. Kacou explains what he means by that:

besides the unusual spark in [their] eyes, combine obsession to succeed and moral purpose so his heart will drive him to the right direction, wherever it is.

Telephone entrepreneur on the streets around Church Square, Pretoria, South Africa. Image by Flickr user The Wandering Angel (CC BY 2.0).

Beside the recognition of real potentials, many African entrepreneurs are just fighting the general perception of gloom and doom for the continent. For instance, Donald Bobiash, Director-General of Africa at Foreign Affairs and International Trade Canada, wrote the following about the “Africa Rising” conference held in Toronto on March 14-15, 2011:

while the media likes to talk about what is wrong with Africa, we are here to talk about what is right in Africa.

Indeed, as an analysis in The Economist pointed out earlier this year:

over the ten years to 2010, six of the world’s ten fastest-growing economies were in sub-Saharan Africa

The reason for this rapid growth in the region are not straightforward though. In a Mckinsey Global Institute report, Acha Leke et al unpack the various reasons behind Africa's growth:

…yet the commodity boom explains only part of Africa’s broader growth story. Natural resources, and the related government spending they financed, generated just 32 percent of Africa’s GDP growth from 2000 through 2008.The remaining two-thirds came from other sectors, including wholesale and retail, transportation, telecommunications, and manufacturing.

Entrepreneurs epitomize this growing trend of seizing the opportunities that the continent presents. Tal Dehtiar from Oliberté Shoes – a shoe manufacturing company with operations in Ethiopia and Liberia- is one of them. He writes in a blog entitled Oliberté, This is Africa the reason for investing on the continent:

we never have and still don't see an Africa that's categorised by negative generalizations. Oliberté believes that with the right partners, each country within Africa has the means to grow and support its people.

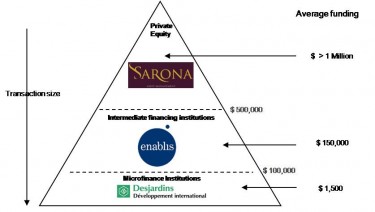

Many African entrepreneurs believe that although the triple bottom line -financial, social, environmental- is the new buzz word for companies investing in developing countries, one fact that need to be made clear is that Africa will not able to sustain the growth if the funding are only about “micro-finance”, and financing a woman with “50 US dollars”.

Difference in average transaction size between private equity and international development funds. Diagram to be credited to the author of the article

African Entrepreneur explains:

Development, social and micro-finance are not evil. They have their role and do help keep millions out of poverty. But Africa cannot develop by simply trying to not be poor. We need real multi-million dollar financing for African innovation. Is there risk? Of course there is, but no more than funding an online pet shopping site in Silicon Valley.

She goes on quoting Mfonobong Nsehe in a Forbes article:

Africa has its own Mark Zuckerbergs, Andrew Masons, Mark Pincuses, Larry Pages and Sergey Brins. But it lacks its own Yuri Milners,John Doerrs, Vinod Khoslas and Y Combinators. […] Africans can create hugely successful tech products that will sweep the world off its feet. There are several entrepreneurs out there waiting to break through, but their ideas might never see the light of day because of a lack of seed finance.

The Africa Rising Conference concluded on the following remarks by Dr John Preece:

The overall feeling was one of great positivity and potential, with the general perceptions of Africa not matched by the reality of strong economic growth and exceptional creativity (I was often reminded of a Hans RoslingTEDtalk: Let my dataset change your mindset)”.

This post is part of our special coverage Global Development 2011.

2 comments

Its all about the negative publicity given to africa and the fake NGO`S and foundations who cook stories and write proposals to get funds in the name of developing africa and yet it gets into their pockets.i believe africa can sustain itself without unneccesary aid